Resilient Consumers Keep Spending Despite High Inflation

Call it a conundrum, a paradox, or just call it a head-scratcher. The American consumer has somehow absorbed a high inflationary environment for almost three years and kept the U.S. economy afloat. At the same time, credit card balances, and delinquencies are on the rise. There has to be a day of reckoning somewhere… right?

Luxury Goods Demand Still Strong in 2024

If you believe the CEO of Saks Marc Metrick, demand for luxury goods is, “Here to stay in 2024.” Luxury products can be defined as higher-end cars, fashion, jewelry, even homes.

Metrick says the luxury market is a sentiment-based business, and if you look at recent data from the Conference Board’s Consumer Confidence report released last week, you will find that the index rose to its highest level since December, 2021. Consumers are feeling more confident about the economy.

Luxury Goods Demand Still Strong in 2024

If you believe the CEO of Saks Marc Metrick, demand for luxury goods is, “Here to stay in 2024.” Luxury products can be defined as higher-end cars, fashion, jewelry, even homes.

Metrick says the luxury market is a sentiment-based business, and if you look at recent data from the Conference Board’s Consumer Confidence report released last week, you will find that the index rose to its highest level since December, 2021. Consumers are feeling more confident about the economy.

Mixed Signals on Consumer Confidence and Caution

LPL Chief Economist Dr. Jeffery Roach points out that confidence is driven at least partially by the exuberance that the Fed has completed its rate hike cycle and will soon cut rates. There are some yellow flags in the Consumer Confidence report, though. Consumer plans to buy big-ticket items in the next six months fell across the board.

Goods vs Services Spending Trends

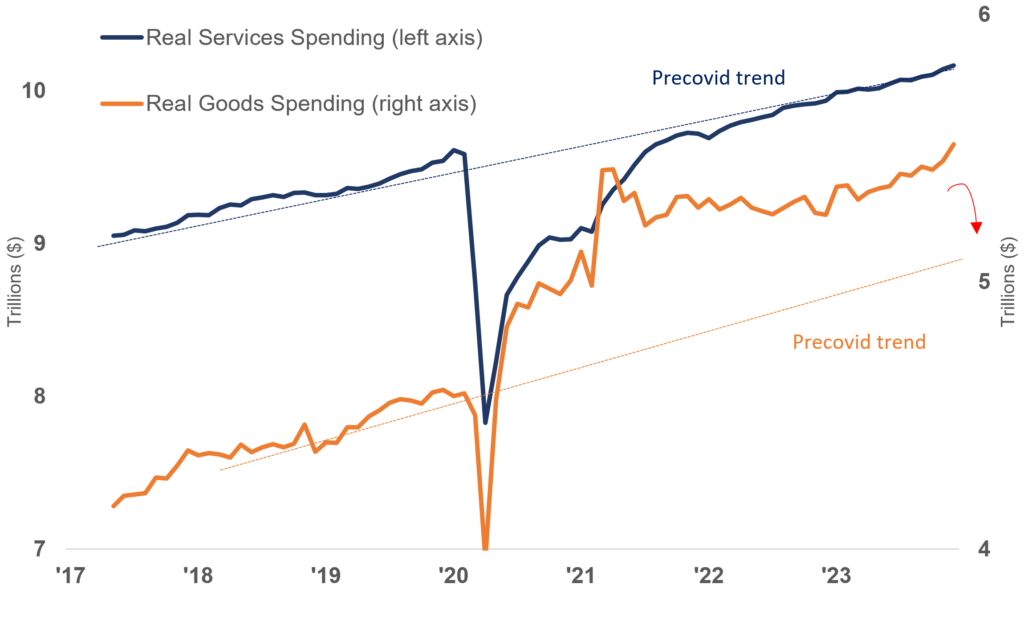

Here’s a chart showing what consumers are spending their money on.

This shows a spending comparison over the past seven years between services and goods. We’ve talked about this before. Before COVID, we were spending a couple trillion more on services than we were on goods. When the pandemic hit, we hit an all-stop on spending for a time. Then, in 2021, spending on goods surpasses spending on services, driven largely by the fact that so many businesses were closed or not operating at full strength. But, over the past three years, services are back on top, and the margin is looking a little more like the pre-covid trend. The strong demand for goods is slowing, which would track with the report.

Job Market Factors and Impact on Spending

It’s possible that consumers are becoming more cautious about spending, but not shutting it down. Of course, their household circumstances matter. If they are maxed out on credit, that looks different than if they still have plenty of disposable income. If they still have a job, or if they are satisfied with their job, matters too. We know unemployment rates are still historically very low.

Late last week a report called Job Openings and Labor Turnover Survey showed that quit rates, an indicator of employee confidence, are down to pre-pandemic levels. According to Dr. Roach, quit rates fall when workers expect a low probability of easily getting rehired.

Consumer Spending Impacts Economy and Investments

Taking a hard look at consumer spending matters. It accounts for roughly 80% of the American economy. If that slows, it can obviously affect corporate earnings, which in turn, can affect stocks. The latest report shows us confidence is high but where a consumer spends their money may be more strategic, which means maybe your investment strategy should be, too.

Past performance isn’t indicative of future results. All information contained in this blog is for general information only and shouldn’t be considered investment advice.