Inflation Data Spooks the Market

Headline inflation numbers exceeded expectations. The January Consumer Price Index (CPI) rose 0.3% month-to-month and 3.1% year-over-year. Economists predicted a monthly increase of 0.2% and 2.9% yearly. The inflation rate was mainly driven by a 0.6% monthly surge in shelter prices.

Stocks Fall on Rate Cut Fears

The higher-than-expected inflation data sparked large stock market declines on Tuesday, February 14th. Investors worried the Federal Reserve may delay interest rate cuts due to stubborn inflation.

Dip Buying Resumes on Cooler Heads

However, by Wednesday, February 15th, stocks bounced back from the inflation-induced selloff. Analysts think shelter inflation will moderate over 2023. Fed rate cuts could still happen later this year.

Follow the Money: Value and Small Caps vs Bonds

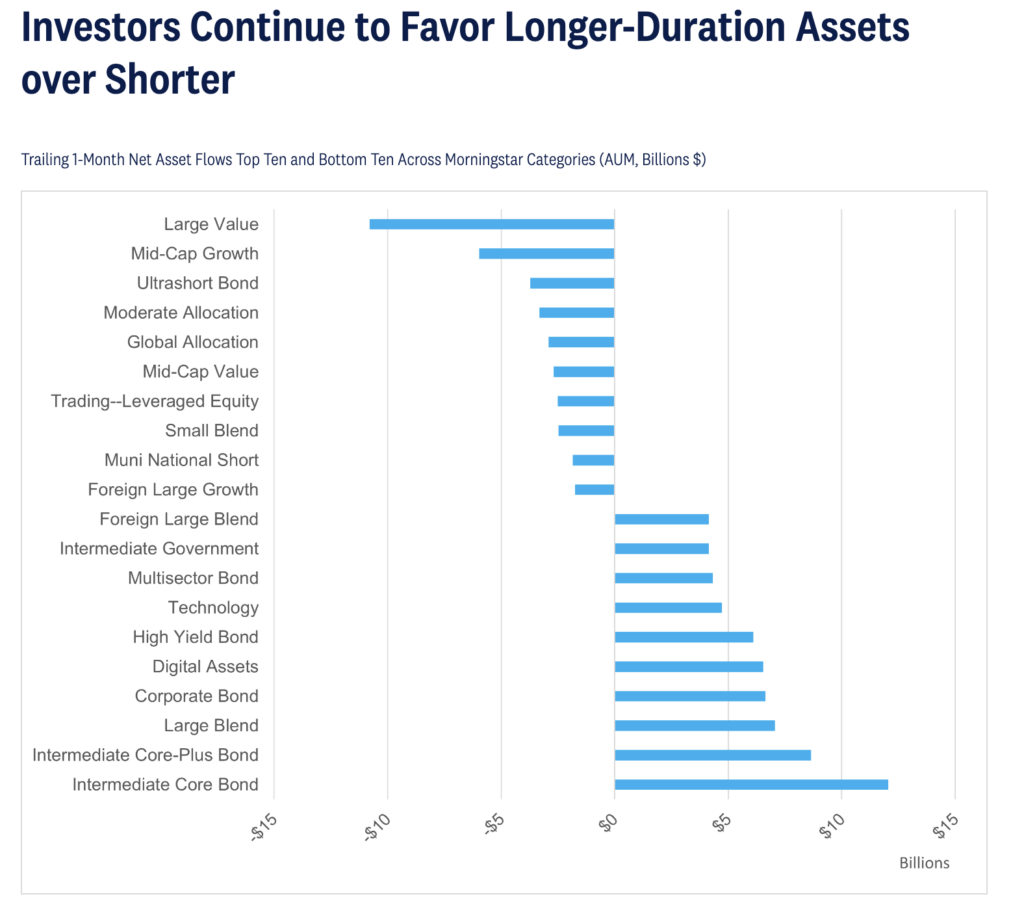

Check out this chart:

You can see the largest outflows in January were in Large Cap Value. This category of funds saw $10.8 billion leave last month. This continues last year’s trend. Following that category, Mid-Cap growth, along with other Mid-Cap and Small-Cap funds saw large outflows. This also continues a trend. You can look at the major indexes and see that. The Russell 2000, which tracks many of those companies is down about 2% Year-to-Date, while the other major indexes are positive.

At the bottom of the chart, you can see the biggest inflows. The leader? Intermediate core and intermediate core-plus bonds. These categories experienced inflows of $12 billion and $8.6 billion, respectively. These bond categories have a longer duration, meaning investors are expecting to be rewarded by interest rate cuts. As we’ve discussed before, if rates fall, the values of bonds will go up.

Key Portfolio Takeaways

Bonds could provide stability and upside. With unlikely further rate hikes, conditions seem favorable for bonds to deliver diversification and possible total return. Given lukewarm flows to mega-cap tech stocks, smaller stocks, and value categories could participate more in any 2024 rally.

Past performance isn’t indicative of future results. All information contained in this blog is for general information only and shouldn’t be considered investment advice.