The rumors are true… September is officially the WORST. I’m not trying to be melodramatic here, either. The numbers back me up! How bad is it, and what should you do to brace yourself for September’s temperamental track record? Let’s take a look.

Historically Horrible

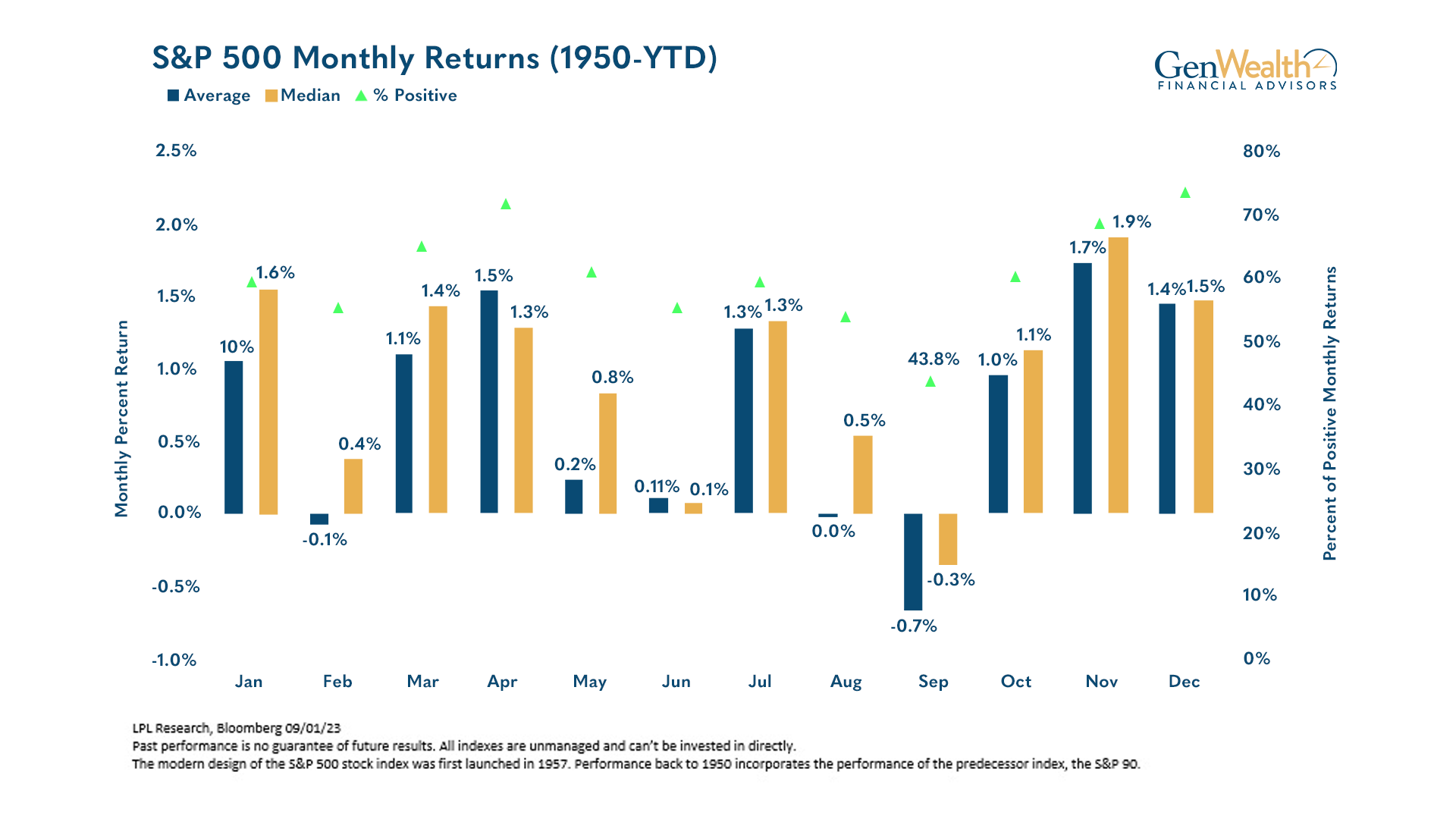

This month is historically the worst for stocks, dating all the way back to 1950. Even if you vary lengths of time and pick out periods of 10-year, 20-year, etc. this rings true, especially for pre-election years, which we happen to be in now. Of course, this time COULD be different (more on that later), and past performance isn’t indicative of future results, but the pattern shown by the data is strong.

Check out what this chart shows us. It’s a little busy, but the gist is this: both the average and median returns for September are in the negative. No other month experiences returns quite like that. September also has a significantly lower chance of positive returns than any other month (43.8%).

The Nitty Gritty

The behavior of the market is pretty complex, though. So, let’s take a closer look.

How does the market perform in September following an up or down August? Also, how does the market perform in September when it is in an uptrend or downtrend?

Although the S&P 500’s monthly winning streak is over, upside momentum may continue. Historically, after the end of a five-month winning streak, the market has continued higher over the next six months, generating an average gain of 7.3%.

Of course, September’s tendency to be less-than-exceptional could be a spoiler for this recent rebound, but the outlook isn’t all doom and gloom. When the S&P 500 enters the month above its 200-day moving average, it tends to do a little better than when it heads into September below that figure.

Keep Calm and Invest On

So, should you be running for the hills and sidelining your investments through September? The short answer is no! There are two main reasons why:

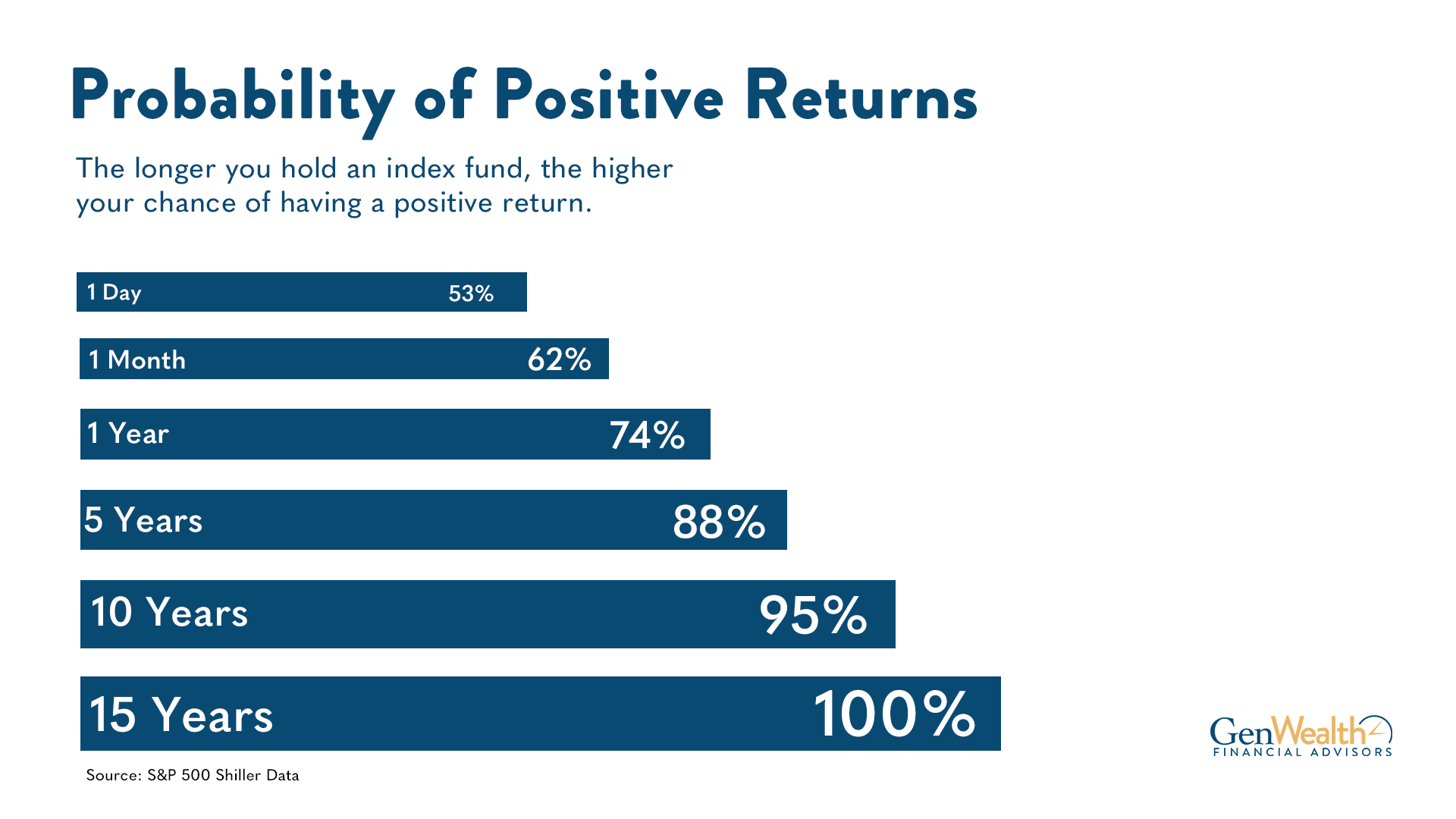

- The longer you invest, the better your probability of positive returns.

- You’re practically missing out on “cheaper” investing.

First things first. Investing should be a long-term process, especially if you’re working with money you will need at some point in the future. You wouldn’t want to head to Vegas to gamble with your hard-earned retirement savings that you plan to use for necessities like food, shelter, etc., but that’s basically equivalent to what you’re doing if you’re trying to time the market with it.

Now, let’s work on shifting your mindset about market volatility. It’s crucial you know this: volatility is a given. The very nature of the market is to experience ups and downs. Otherwise, your money wouldn’t have the potential to grow! It’s reasonable to be concerned about your hard-earned money, but history shows us that the longer you invest, the better your likelihood of seeing a positive return.

So, let’s talk about a little strategy called dollar cost averaging. The principle is simple: whether the market is high or low, you invest the same amount of money. The goal is to collect shares. That means if the market is going strong, your set amount of money will purchase fewer shares, but when the market dips, you get to purchase more shares for the same amount of money. Think of it like a sale at your favorite store – you get more for the same price!

When you look at market volatility through this lens, you see the opportunity it can give you. Now, this strategy is not a protection against risk, because all investing involves risk. But it’s up to you to determine how much risk you’re willing to take for the reward you’re looking for.

The Bottom Line

What does all this mean for you? Here are some key takeaways:

- Timing the market is a gamble, but time in the market increases your probability of positive returns.

- The behavior of the market can be influenced by so many factors, and no one can truly predict what’s going to happen.

- The “September slump” can be nerve-wracking, but don’t let sensational headlines and short-term volatility derail your progress.

- Dollar cost averaging can help shift your mindset about dips in the market.

Just remember… investing is a long-term process, so stick to your plan (and if you don’t have one, get one)!

P.S. – If you want to keep up with the market and everything going on in the world that could impact your money, click here!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The S&P 500 is an index that cannot be directly invested in, and examples used in this blog are for illustrative purposes only. All examples are hypothetical and are not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. Past performance is no guarantee of future results.