The stock market is often perceived as intimidating and uncertain, and this keeps many from embracing the benefits investing could bring. This fear is particularly prominent among younger generations, though it’s apparent across the ages. I’m going to uncover five bombshell truths about the market that can help clear up its complexities and empower you to make informed investment decisions.

1. The Long-Term Triumph of the Stock Market

Over time, the stock market has demonstrated remarkable resilience. Despite the daunting challenges it has faced throughout history, it has managed to overcome every obstacle. When looking at historical data, a reassuring pattern emerges:

- Over a 10-year period, the risk of a negative return is less than 6%.

- Across 15 years, there has never been a rolling period of negative returns on the S&P 500.

- Notably, stocks gain an average of 114% during bull markets, while they lose only about 36% during bear markets.

These figures, drawn from sources like Hartford Funds, underscore the importance of long-term investing and highlight the market’s ability to rebound from setbacks. Now, of course, past performance isn’t indicative of future results, and all investing involves risk. But the numbers above still hold true – anyone who has bet against the U.S. economy long-term has lost.

2. Short-Term Uncertainties: Holding On for the Ride

Navigating the short-term fluctuations of the market can be challenging. The fear of losing money when the market is volatile can lead to hasty decisions, but it’s essential to maintain perspective. Most investors are primarily concerned about having sufficient funds when they need them. It’s crucial to question whether an immediate need for money actually exists. If not, succumbing to the pressure of selling during a downturn is often not the best strategy.

Market volatility is inevitable, yet it doesn’t necessarily dictate a need to sell during a bear market. The key is to have a plan that accounts for the short-term turbulence and gives you other sources to withdraw income from WHEN the market is down. If you don’t have a plan, you likely aren’t prepared to navigate a bear market or recession without having to lock in your losses and sell.

3. The Changing Face of Bear Markets

Bear markets are often dreaded due to their suddenness and account balance declines. This is an understandable concern! However, the truth is that bear markets have evolved over time. Post-World War II, they’ve become less frequent, occurring approximately every 5.4 years compared to the pre-1945 frequency of 1.4 years.

The average duration of a bear market is around 9.6 months, significantly shorter than the average length of a bull market at 2.7 years. These shifts underscore the evolving nature of market cycles, offering a glimmer of hope amid the challenges.

4. The Agonizing Cycle of Doubt

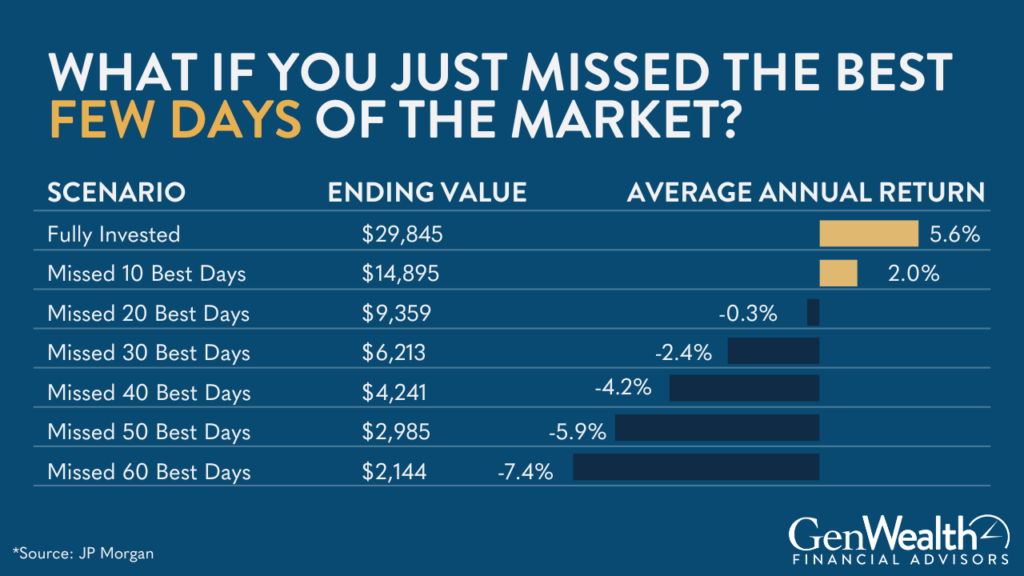

Emotional investing can lead to an endless cycle of doubt and hesitation. There will always be reasons not to invest, but focusing on long-term goals (and understanding my first point above) provides a compelling reason to invest. Think about it this way: What if you went to cash and ended up missing just a handful of the best days of the market? Now, you’d likely think, it’s just a few days. How much difference could it make? A major difference, actually! Take a look at this chart:

In this example, missing just the ten best days in the market causes you to also miss out on nearly $15,000! Now, I’m not going to discount the fact that investing fear is real. It’s only natural to be concerned about the money you’ve worked so hard to earn when there’s volatility in the market. That’s why it’s so important to have a strategy and a written plan. When things get a bit turbulent, it’s a comforting feeling to know where to turn and what to do.

5. The Great Unknown: Unpredictability of Market Trends

One of the most significant bombshell truths is that no one can predict the market’s future with certainty. The numerous predictions made by financial experts for the 2022 S&P 500 year-end demonstrate this point. Their projections ranged from 4,400 to 5,300, yet the actual value was 3,839.50.

This unpredictability doesn’t render these experts less intelligent; rather, it highlights the inherent uncertainty of the market. What you should take away from this is that relying solely on predictions isn’t a sound investment strategy.

Bottom line: The stock market’s perceived complexity and uncertainty can be mitigated by embracing these five bombshell truths:

- The long-term strength of the stock market prevails through history’s challenges.

- Short-term volatility doesn’t necessarily warrant immediate action.

- Bear markets have evolved and they’re less frequent than they used to be.

- Emotional investing leads to doubt while focusing on long-term goals encourages action.

- The market’s unpredictability emphasizes the importance of strategy over speculation.

While no one can predict the market’s future, strategic planning, goal-oriented investing, and preparedness for uncertainties can tip the odds in your favor. That’s why it’s so important you understand these truths. By creating a plan specifically for you on paper, on purpose, you can approach the market with greater confidence and set yourself on a path toward true financial independence.

P.S. – If you want to keep up with the market and everything going on in the world that could impact your money, click here!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.