Alarming Inflation Headlines Demand Context

U.S. News and World Report announced, “Inflation remains a problem as March Consumer Prices come in above expectations.” Forbes went with, “Inflation much worse than expected in March.” CBS News chimed in with, “Inflation runs hot for third straight month.”

Unpacking the March CPI Numbers

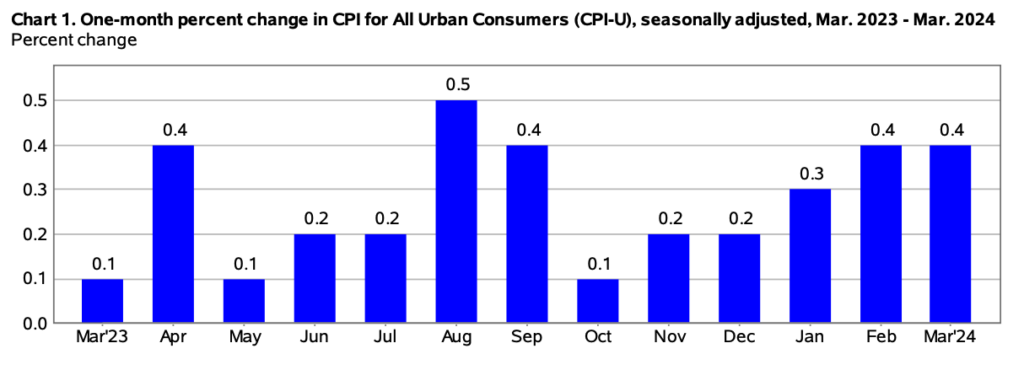

First, let’s look at the numbers. The Consumer Price Index, which a is a broad measure of prices, was up .4% in March, when compared to February. The consensus expectation among economists was that it would be up .3%.

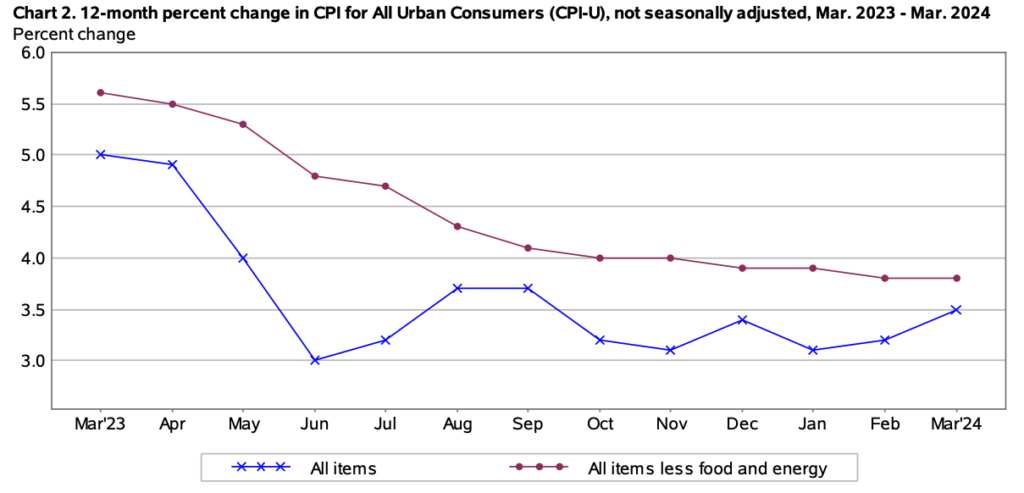

Year over year, inflation was up 3.5%. Economists expected 3.4%.

Key Contributors to March Inflation Spike

Digging a little deeper, we find that over half of the monthly jump can be contributed to gas prices and shelter prices, which would include rent. Energy prices were up 1.1% month over month.

Silver Linings in Food and Grocery Prices

There were a couple of bright spots in there too. The food index was up only .1% in March, and the food at home index, which is grocery prices, was unchanged.

Month-to-Month Changes

The first chart shows the month-to-month increases in the CPI over the past 12 months. The March number is not even the highest monthly jump in that period, and matches February.

Annual Inflation Rate

The second chart tracks the 12-month inflation rate over the past year, highlighting the overall downward trend from 5% a year ago to the current 3.5%.

Historical Context for Inflation Figures

As a reminder, the long-term average inflation rate in the United States is 3.1% going back to 1913.

Implications for Interest Rates and Fed Policy

Investors are worried that the Fed will delay cutting interest rates if inflation ticks up, as they target a 2% inflation rate.

Economic Health Despite Inflation

The economy has taken all of this in stride and is healthy – strong labor market, steady wage growth. The Fed’s rate decision may not be a major headwind.

Balanced Perspective on Inflation Concerns

The bottom line is that inflation is slightly above historical averages, and interest rates are around averages too. Things are never as good or bad as they seem.

The opinions voiced in this video and blog are for general information only and are not intended to provide specific advice or recommendations for any individual.

To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Independent Advisor Alliance. Independent Advisor Alliance and GenWealth Financial Advisors are separate entities from LPL Financial.