Check the background of this firm on

Recession Watch: Dr. Roach and the LPL Research team shared their perspective on an impending recession at our recent event, projecting its occurrence in late 2023 or early 2024. Despite this, the consensus was that the recession would likely be of short duration and limited depth, offering reassurance in uncertain times.

Market Mindset: The LPL Research team released their Mid-Year Outlook this summer and their fair value target for the S&P 500 is in a range of 4,300-4,400. As of this recording, the Index is at 4,413. This would suggest very little upside for stocks for the remainder of the year.

On August 22nd, we had the opportunity to bring to Little Rock, the Chief Economist for LPL Financial, Dr. Jeffrey Roach. He joined us for a Q & A with GenWealth, our clients, and their guests, discussing the economy, the market, and how investors should prepare for the next 12 months.

We discussed everything from the U.S. debt, to inflation, to the 2024 Presidential election, and the stock market, to Dr. Roach’s latest take on the odds of a recession.

He and the LPL Research team still believe the economy will enter recession late this year or early in 2024, but that it will not be a long or deep recession. You can watch the video above

So, what does that mean for the stock market? The LPL Research team released their Mid-Year Outlook this summer and their fair value target for the S&P 500 is in a range of 4,300-4,400. As of this recording, the Index is at 4,413. This would suggest very little upside for stocks for the remainder of the year. It is important to note, that a fair value target is not a prediction of where the market will actually be, but rather where it should be. The market often trades higher.

There are also assumptions made about how LPL arrived at that fair value target. What happens with inflation, and the Federal Reserve’s decisions on interest rates can all play a part in changing the market performance.

But, as interest rates potentially level off, and bond yields are attractive, there may be more flows into bonds and away from stocks for a short time.

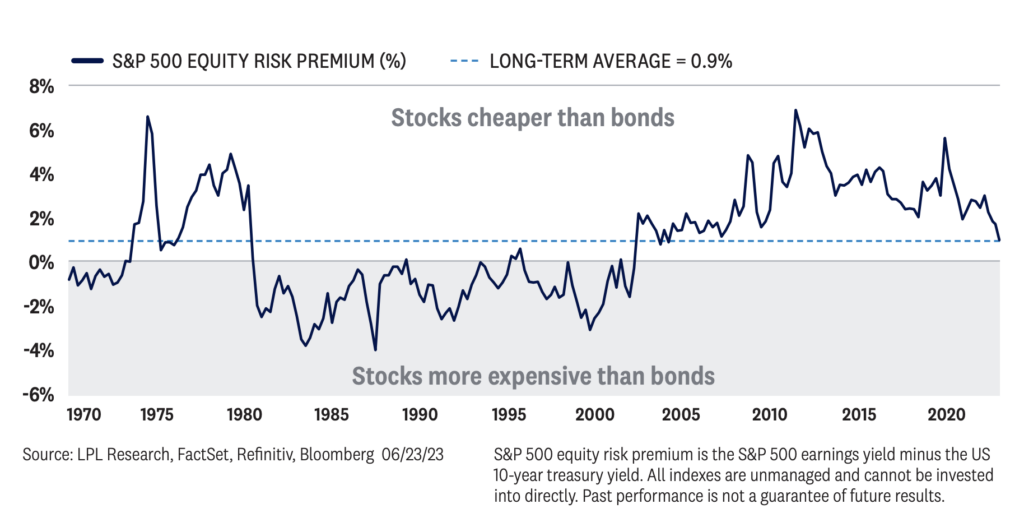

Take a look at the chart above. This chart tracks what is called the risk premium of the S&P 500 Index. The risk premium is basically used to identify the potential reward of investing in stocks, above and beyond the potential reward of investing in bonds. It’s determined by the earnings yield of the Index minus the 10-year U.S. Treasury yield. That’s hard to follow, but the takeaway of this chart is that the top of the chart indicates when stocks are cheaper than bonds, thereby becoming more attractive to investors. The bottom shaded area indicates when stocks are more expensive, and could become less attractive. We are currently right on the line.

The takeaway here is that stock market volatility may increase in the near term as a recession, interest rate hikes, and other variables continue to work itself out. But, remember what Jeffrey Roach indicated. A recession is expected to be short-lived, and stocks are still a great long-term investment.

A Path through the forest

In unstable financial terrain, John and Scott are bringing clarity about market trends for 2024 and more importantly what it means to you!

Join us for this exclusive GenWealth Academy webinar