November’s Market Momentum

Stocks soared in November, fueled by a decisive Presidential election and following seasonal trends. The 5.7% gain in the S&P 500 Index in November was the strongest monthly gain of the year. November has been the strongest month of the year, on average, going back to 1950.

Historical December Performance

December is, on average, the second-best performing month of the year behind November. The average long-term gain in December is 1.6%. It’s been a little weaker over the 10 and 20-year time frames, but it’s made a comeback over the past 5 years, trailing November and July as the third best performing month.

Probability of Positive Returns

December leads all months with a 74% probability of positive returns since 1950. This is one of the reasons why the term “Santa Claus rally” has been coined, referring to the positive stock market gifts that usually come around Christmas time.

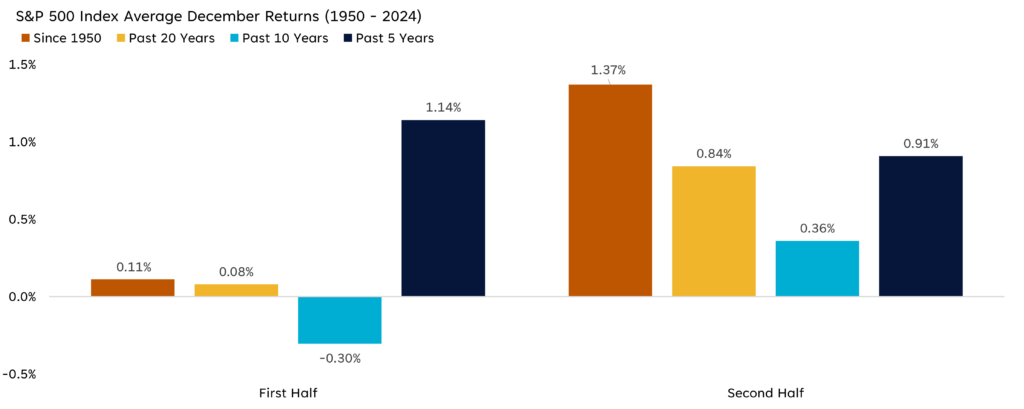

Timing Matters: First vs. Second Half

LPL Research charts reveal a stark difference between the first and second halves of December. The first half of the month has even been negative, on average, over the past 10 years. The second half of the month consistently outperforms.

Investment Wisdom

Every December has its own underlying economic conditions. No matter if we get a Santa Claus rally or a big lump of coal in our portfolio stockings, investors should stay focused on their long-term goals. One month will not make or break your financial independence. One year won’t. Not staying invested will.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Independent Advisor Alliance. Independent Advisor Alliance and GenWealth Financial Advisors are separate entities from LPL Financial.