We are looking at homeowner activity for some guidance on the health of the economy.

Twice a year, the LPL Research Team puts together a Market Outlook. They release one in January, and the second in July. The Mid-Year Market Outlook is built to look ahead for the final six months of the year, at the economy, the stock market, and other asset classes.

Economic Forecast: Slowdown Without Recession

The headline from this summer’s outlook? The LPL Research team believes the economy is slowing, but will not likely slip into a recession this year.

Now, if you follow the Fastest 4, you may be thinking, “Didn’t LPL think there would be a recession in 2022 or 2023?” The answer is yes. But, in the Mid-Year outlook, they give us some thoughts on where they missed, and it’s in the housing market.

Consumer Spending Drivers: Beyond Stimulus

You may remember, the reason given for strong consumer spending in the months and years following the COVID-19 pandemic was all the stimulus money. And that reason was given for a long time. If you’re like me, you may have wondered how that money lasted for so long?

Turns out, there may have been another source of strong consumer spending.

Refinancing Boom: A Key Economic Factor

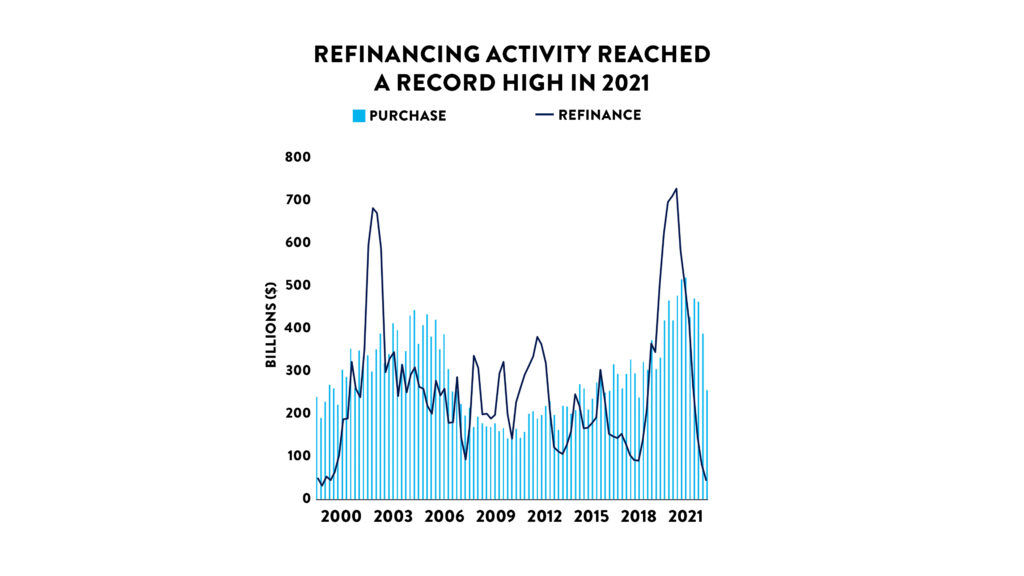

Take a look at this chart.

It shows home refinancing activity overlayed onto home purchases. You can see the spike in 2003 and again in late 2020, when rates were very low. LPL reports that one-third of all U.S. mortgages were re-financed in the months following the 2020 recession. In fact, according to the Federal Housing Finance Agency, roughly half of all mortgages now have an interest rate below 4%.

Dual Impact of Refinancing on Consumer Spending

The impact of this activity on consumer spending was two-fold. First, Homeowners lowered their monthly payment, thereby giving them more disposable income. The New York Fed estimates that homeowners average gain was $220 per month from re-financing in the months following the 2020 recession.

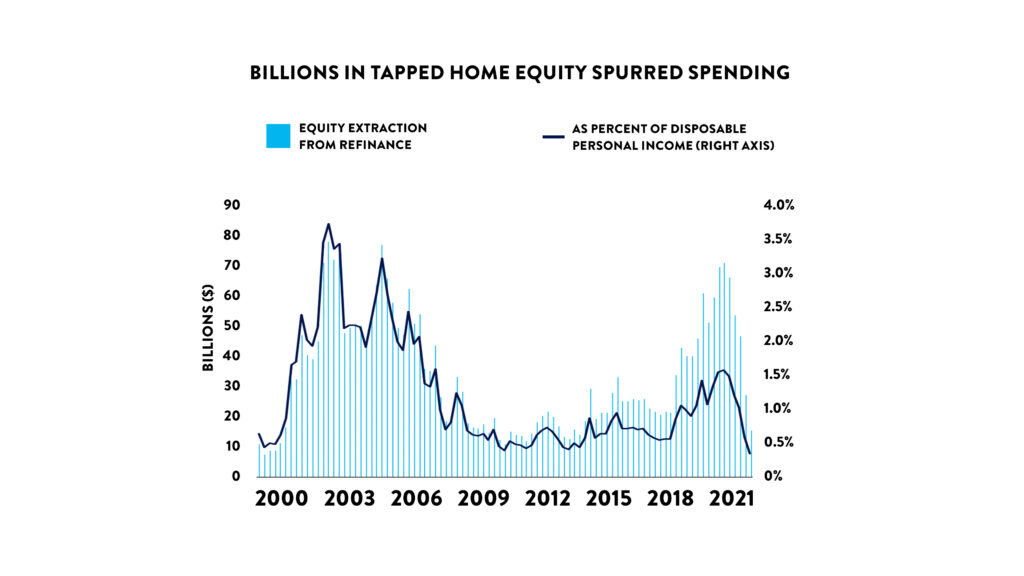

Now look at this chart.

The light blue on this chart shows the billions of dollars in tapped home equity from those re-finances. You can see in 2021 homeowners accessed about $70 billion in home equity. That money helped buoy consumer spending as well.

Homeownership Trends: Mortgage-Free Living

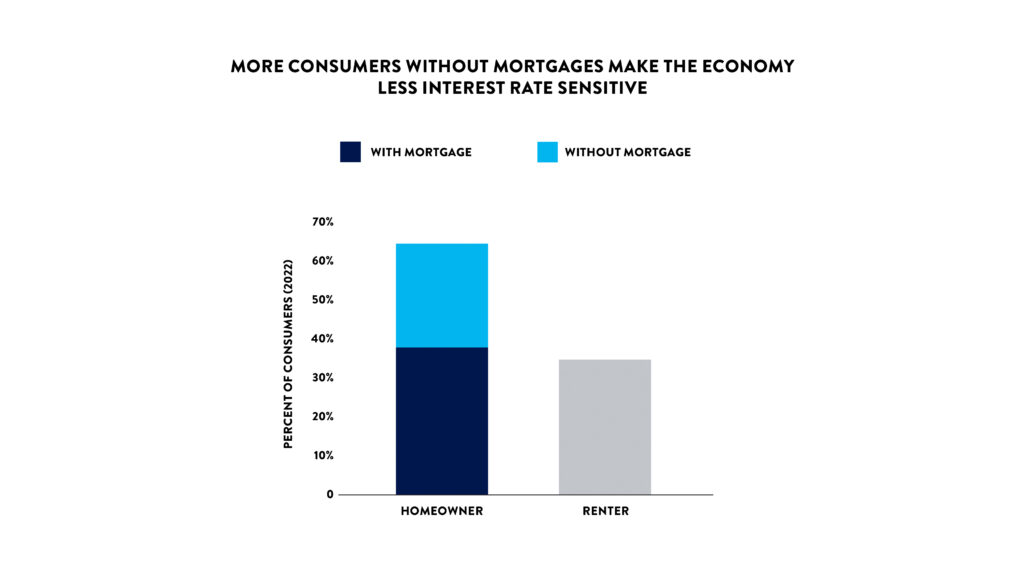

There are also more and more American homeowners living without a mortgage. Look at this chart.

The dark blue column represents the almost 40% of consumers who own a home, but still have a mortgage. The light blue column represents about 30% of homeowners who do not have a mortgage. A little more than 30% are renting.

Future Outlook: Consumer Spending and Economic Slowdown

As we know, consumer spending drives about 70% of the U.S. economy. If the stimulus money drove spending, followed by homeowners gaining more disposable income, and cashing out home equity, what happens next?

LPL says consumer spending is showing signs of stalling out. Their team expects slower spending in the second half of the year. Combined with other factors, they expect an economic slowdown, but again, no recession.

The opinions voiced in this video and blog are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Independent Advisor Alliance. Independent Advisor Alliance and GenWealth Financial Advisors are separate entities from LPL Financial.