Inflation Surprise: Prices Unchanged in May, Defying Expectations

May inflation numbers were released this week and it was good news. But, I always love reading the hyped headlines. Here’s a sampling: Inflation Surprise: Prices unchanged in May, defying expectations, CPI inflation shock sends stocks soaring, revives Fed rate-cut bets.

CPI Inflation Data Analysis: 3.3% Annual Increase

The reality is that inflation was flat month to month, meaning the Consumer Price Index, which is a large measure of overall U.S. prices, did not rise at all from April to May. Year-over-year, the CPI was up 3.3%.

The surprise part of this was that economists expected a 3.4% increase over the past 12 months, and 0.1% month-over-month. So, not really a shock.

Stock Market Rally on Inflation Data and Fed Rate Cut Hopes

Stocks did, in fact soar, immediately after the numbers were released. The S&P 500 Index popped over 1%, the NASDAQ rose nearly 2%, and the Russell 2000 was up about 2.8%. 10-year bond yields dipped by nearly 3%.

The cause for the rally is, of course, the bet that the better the inflation data, the more likely it is that the Federal Reserve will begin to cut interest rates later this year.

Perspective on Cumulative Price Increases Since 2020

If you’ve listened or watched the Fastest 4 for long, you know we like to offer perspective beyond the headlines.

So, here’s the balance you need on inflation. The May numbers are good for the economy, but it is important to remember the cumulative effects of rising prices on consumers.

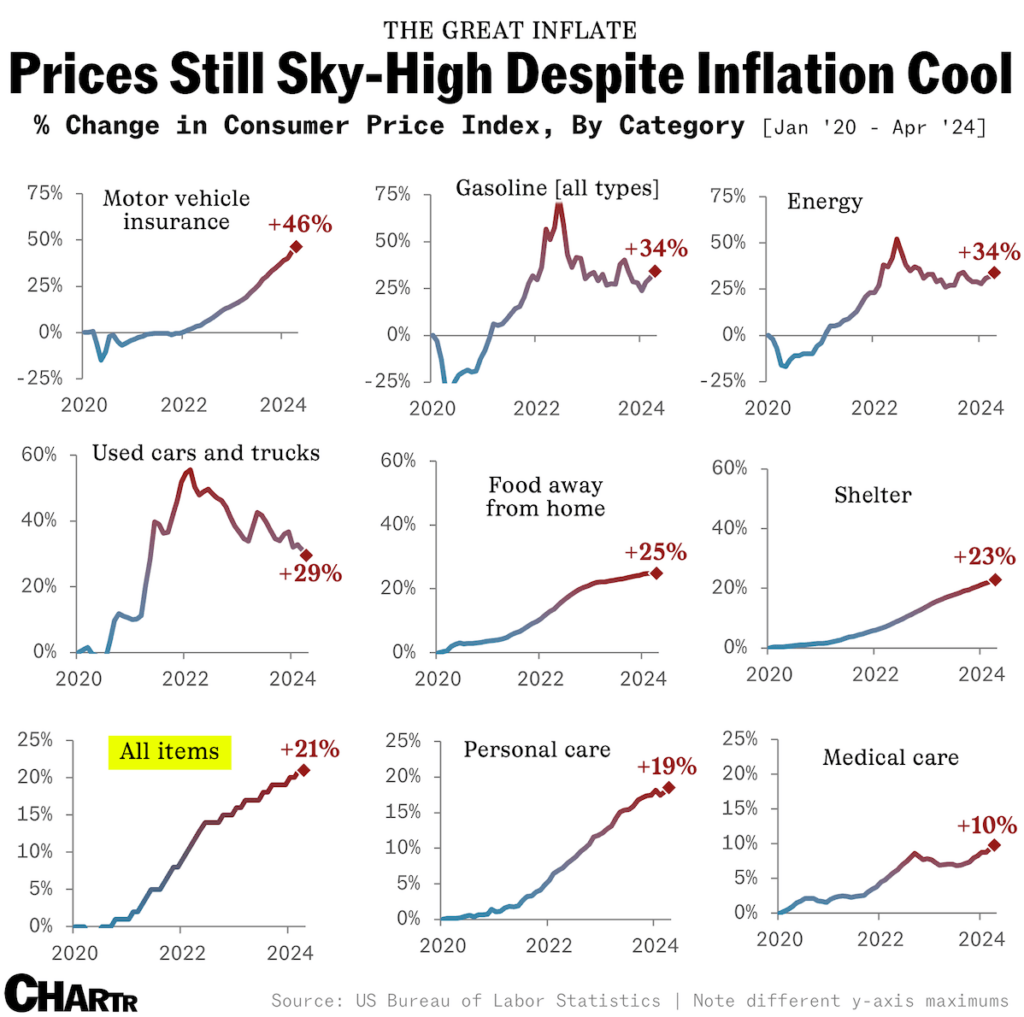

Take a look at this chart from Rocket Mortgage using U.S Bureau of Labor Statistics.

You see 9 categories there with the overall price change since 2020. Auto insurance is up 46% in 4 years. Gas is up 34%, energy is also registering a 34% gain. Used cars and trucks climbed 29%. Restaurant prices have jumped 25%, shelter is up 23%, and overall prices are up 21%.

This illustrates the point that a slowdown in the inflation rate does not mean prices are going down. And, we shouldn’t expect them to.

Ronald Reagan on Impact of Inflation

Ronald Reagan once said that inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.

Battling Inflation: Income Growth and Asset Investing

So, how do you battle against it? In your working years, you have to grow your income. That’s happening nationally.

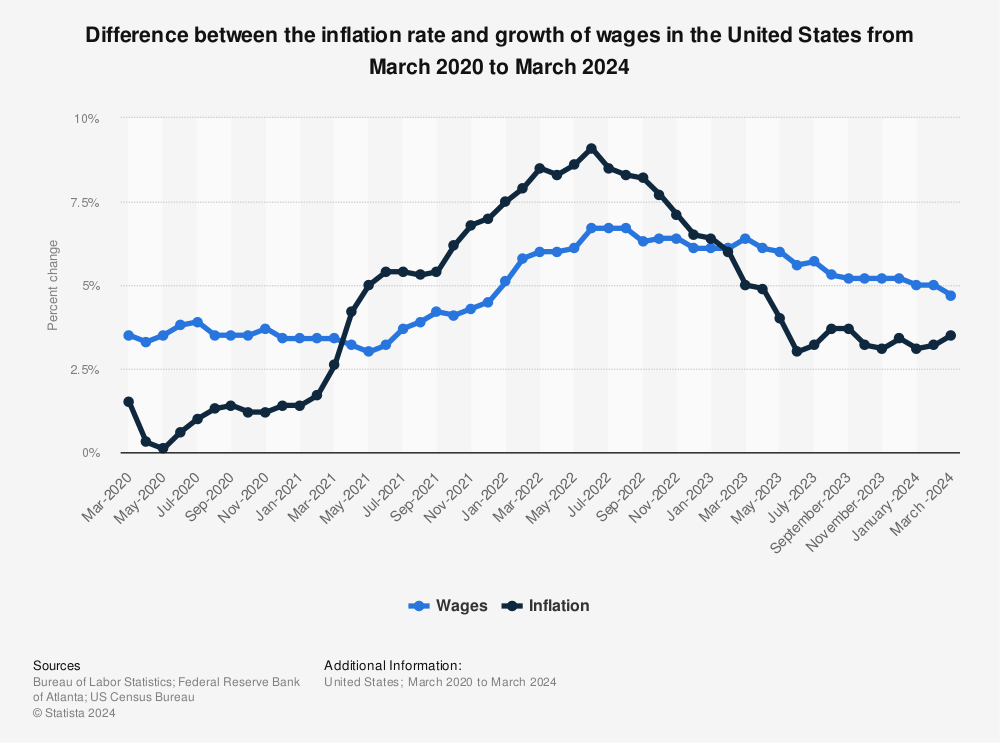

Here’s a chart from Statista that show the wage growth rate in blue, and the inflation rate in black.

You can see prices were going up quicker than workers were getting raises from May, 2021 through February 2023. But that’s changed ever since. Wages are outpacing inflation which would suggest the worker who is getting a raise is able to handle the price increases.

The second thing you have to do to battle inflation is to save money and invest in asset classes that have historically outpaced the rate of inflation. Those asset classes are stocks and real estate. You need this during your working years, and you need to continue to do it on some level in retirement.

Inflation may be a mugger, armed robber, or a hit man, but you have weapons to battle it.

The opinions voiced in this video and blog are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Independent Advisor Alliance. Independent Advisor Alliance and GenWealth Financial Advisors are separate entities from LPL Financial.