Check the background of this firm on

What You Should Know

Stock Market Performance and Slowdown: The 2023 stock market rally, which has seen the S&P 500 Index rise by over 15% year-to-date, has slowed down notably in August, prompting questions about its future trajectory.

Factors Influencing Volatility: August’s market volatility has been influenced by events such as Fitch’s downgrade of the U.S. credit rating and less-than-stellar economic data from China. The uncertainty surrounding the Federal Reserve’s actions, despite softened language on interest rate hikes, is also contributing to the market’s current state.

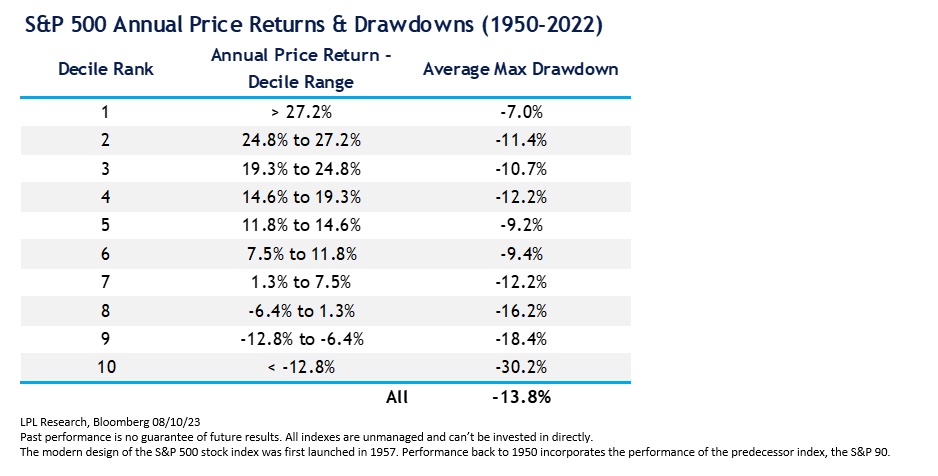

Historical Context and Perspective: Historical data analysis shows that pullbacks are a normal part of market behavior, particularly during years when the market sees similar gains as in 2023. Understanding that market fluctuations are inherent in bull markets is important for maintaining a balanced perspective and making informed decisions in response to potential market dips.

Stock Market Slowdown

As of this writing, the S&P 500 Index is up more than 15% year-to-date. But, it’s been sluggish in August. So, in today’s Fastest 4, we take a look at how a pullback may be coming, but if it happens, it doesn’t mean you should panic.

There’s certainly been news that has been a driver of market volatility in August. Fitch’s downgrade of the U.S. credit rating, and underwhelming economic data in China, being a couple of examples.

There’s also the lingering uncertainty of what the Federal Reserve will do next. Even, as their language has softened on the likelihood of future interest rate hikes, they still haven’t officially taken their foot off the gas. In fact, a pullback would be completely normal.

Historical Insights

A Path through the forest

In unstable financial terrain, John and Scott are bringing clarity about market trends for 2024 and more importantly what it means to you!

Join us for this exclusive GenWealth Academy webinar