The Market’s Momentum

If the stock market does not go up from here, it would be the first time that has happened since the S&P 500 Index was created.

RECORD HIGHS AND RAPID GROWTH

The S&P 500 Index has hit two new all-time highs in the past two months. And the market has been on a tear now for three years.

Since the lows of October 2022, the Index is up more than 85%. Anytime you start talking about all-time highs and that kind of growth, it is natural for investors to worry about a pullback — or even a bear market — lurking just around the corner.

WHY ALL-TIME HIGHS ARE NOTHING TO FEAR

That’s not likely to happen. At least in the very short-term. First, it’s always good to remind ourselves that reaching an all-time high is nothing to be worried about. The S&P 500 Index has notched 1,200 all-time highs in its 68-year history. That’s an average of more than 17 per year, or about one every 3 weeks.

HISTORICAL MARKET DATA SUPPORTS CONTINUED GROWTH

Secondly, as we enter November, a key piece of historical data caught my eye this week.

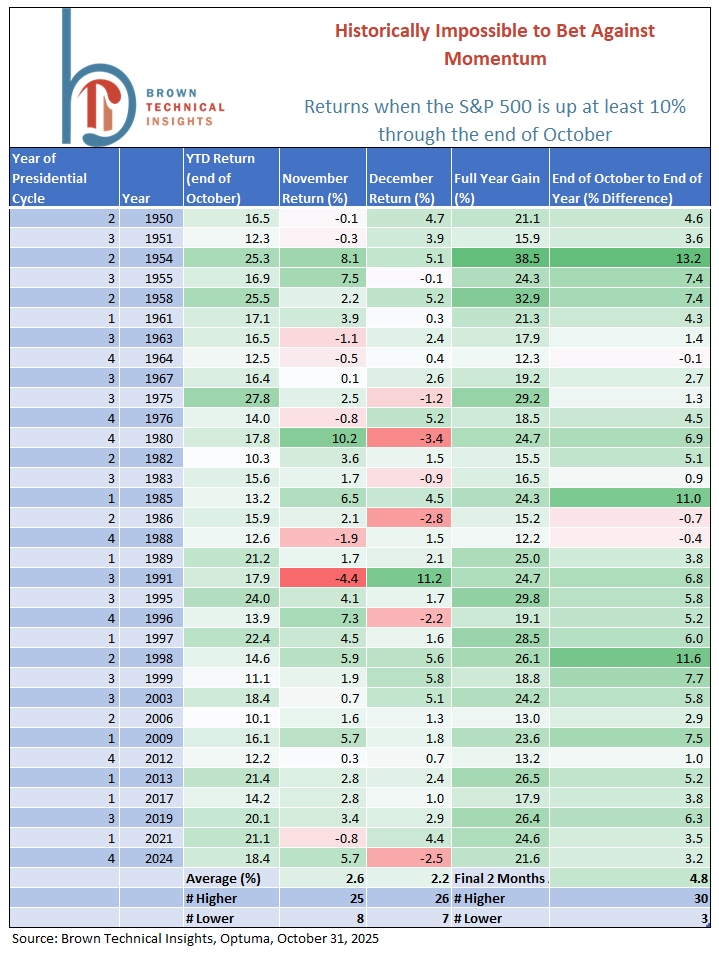

Here’s a look at a chart from Brown Technical Insights. It shows every year that the S&P 500 has finished 10% or higher through October. That’s happened 33 times since 1950. Only three times, was the Index negative in November and December. It happened in 1964, 1986, and 1988. In all three of those years, the Index was down less than 1%.

So, in 30 of 33 instances, when the S&P 500 was up more than 10% going into November, the ride up continued for the rest of the year. On average, the Index was up 4.8% in the final two months of the year.

THE 100% TRACK RECORD OF STRONG YEARS

And taking it a step further, the Index was up more than 16% this year at the end of October. That’s happened 19 times since 1950. And in those cases, the Index was higher in the final two months 19 of 19 times.

So it would be unprecedented for the market to not go higher from here, at least over the next two months.

LONG-TERM INVESTING PERSPECTIVE

Of course, we preach all the time on this platform that we should never make stock investment decisions based on the short-term. This information just serves as a reminder that just because the market is on a great trajectory, doesn’t mean it won’t continue.

At the same time, we have to prepare our mindset that when the market does pull back, or even when the economy sinks into a recession and the market drops even more significantly, that it’s not time to jump ship.

THE BOTTOM LINE: EQUITIES ARE BUILT FOR THE LONG HAUL

Equities are long-term investments used to reach long-term goals.

Securities are offered through LPL Financial, Member FINRA/SIPC. GenWealth Financial Advisors is an other business name of Independent Advisor Alliance, LLC. All investment advice is offered through Independent Advisor Alliance, LLC, a registered investment adviser. Independent Advisor Alliance, LLC is a separate entity from LPL Financial.