That’s So Cliche

Did you know that November 3rd is National Cliché Day? No? Me either. But you know what they say, you learn something new every day. I overestimated

Even if financial independence feels a long way down the road, you’ll never get to where you’re going unless you start from where you are. Balancing life and money can be a complicated task, but the simple fact is that time is the most powerful resource for cultivating the future you deserve. And the best part? You get to decide what it looks like!

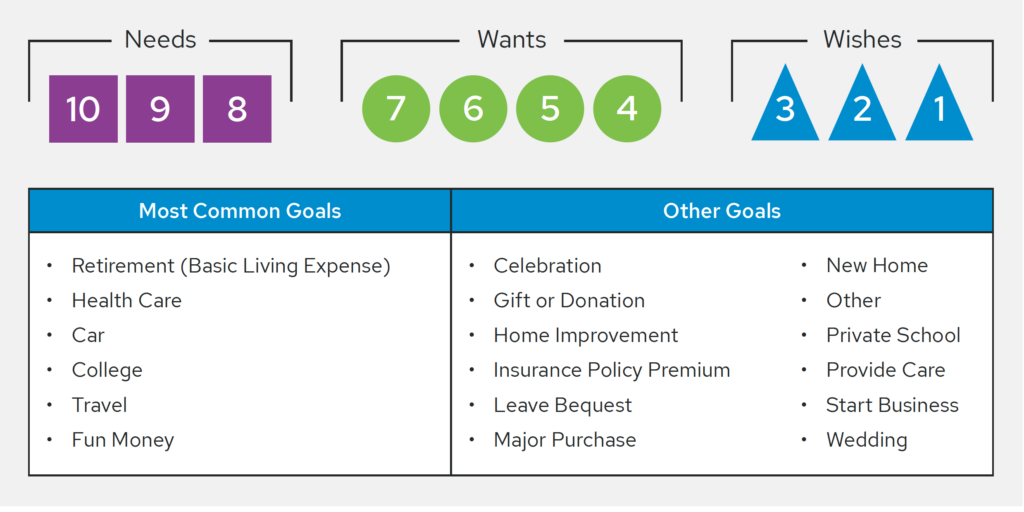

You’re unique, so your financial plan should be too. First, through collaboration with your advisor, you establish your Lifestyle Plan. This helps you identify the needs you must have, the wants you’d like to have, and wishes that you dream about. After all, isn’t planning just a blueprint to turn your dreaming into action?

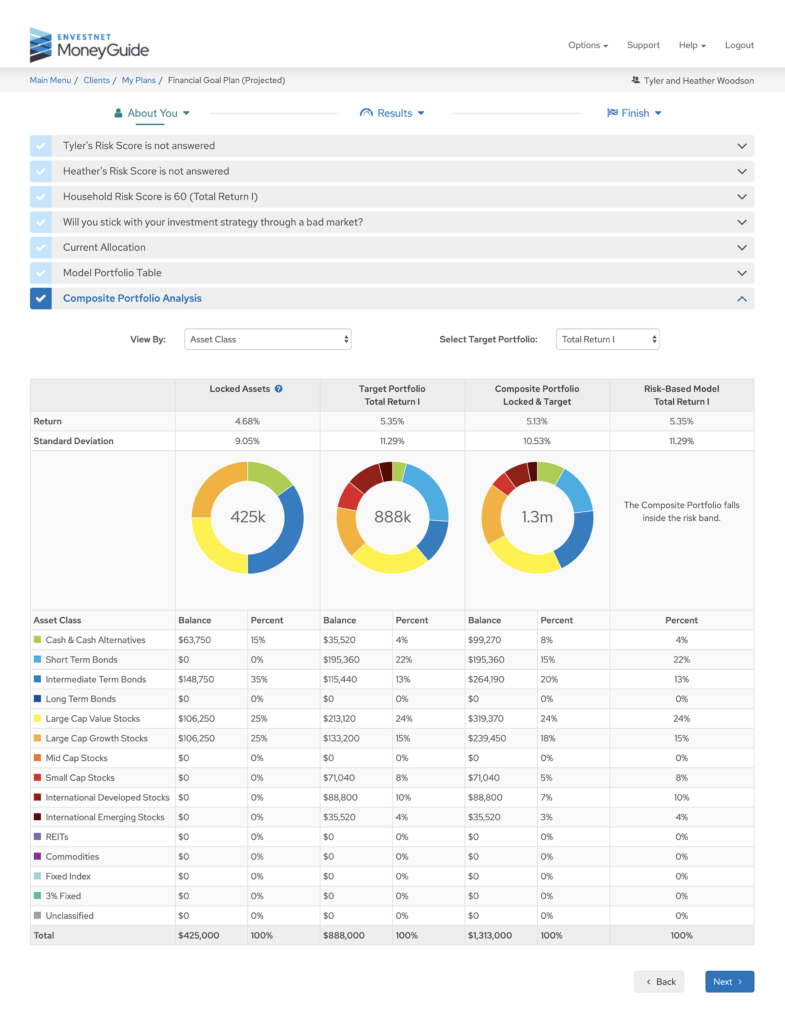

You’ve got big goals, and it’s our job to help put you on the right path to achieve them! The next step in the process is to work together with your advisor to craft a financial plan that is unique to you and your goals.

Things we account for in this step:

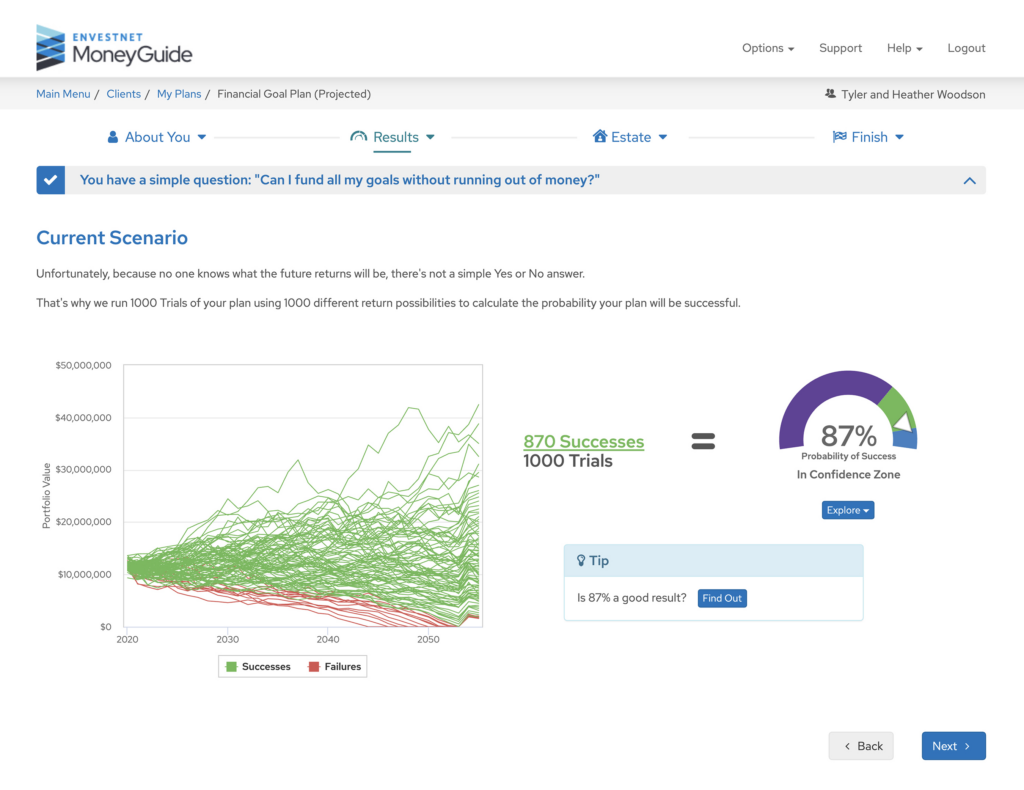

“How can I be certain I’ll reach all of my goals?” Unfortunately, because future returns are unpredictable, no one can be certain. They can be more confident. Here’s how: First, your advisor runs your retirement plan through literally 1,000 different scenarios to determine a confidence score. Then, if that number isn’t something you’re quite comfortable with, you have the ability to play with different variables in your plan like savings rate, spending, or major purchase until you do feel comfortable. The good news is that your plan is a living, breathing thing that can be updated and changed as life unfolds.

Did you know that November 3rd is National Cliché Day? No? Me either. But you know what they say, you learn something new every day. I overestimated

Flying by the seat of your pants? That won’t work in a toilet paper shortage OR in reaching your goals! This morning, I picked up

A Path through the forest

In unstable financial terrain, John and Scott are bringing clarity about market trends for 2024 and more importantly what it means to you!

Join us for this exclusive GenWealth Academy webinar