✂️ Entering the Second Year of Rate Cuts

Are stocks set to soar even higher in the wake of the Fed’s rate cut? We explore that in this week’s Fastest 4 Minutes in Finance.

We are technically entering the second year of the Fed’s rate cutting cycle. The first cut came in September of 2024, and we got another one just this week.

👀 Why the Fed Cuts Rates

It’s what investors wanted, and they finally got it. Of course, the Fed’s decision to cut rates is dependent on economic data. If they cut rates, it’s because they believe the economy is slowing down. The unemployment rate is rising, and inflation has cooled, although it remains above their 2% target.

📉 Stock Market Performance in Rate Cutting Cycles

So, if the economy is slowing down to the point that the Fed made a move, you would think the stock market would contract? Turns out, it depends. If the economy avoids recession, the stock market actually has performed quite well in the second year of a rate cutting cycle.

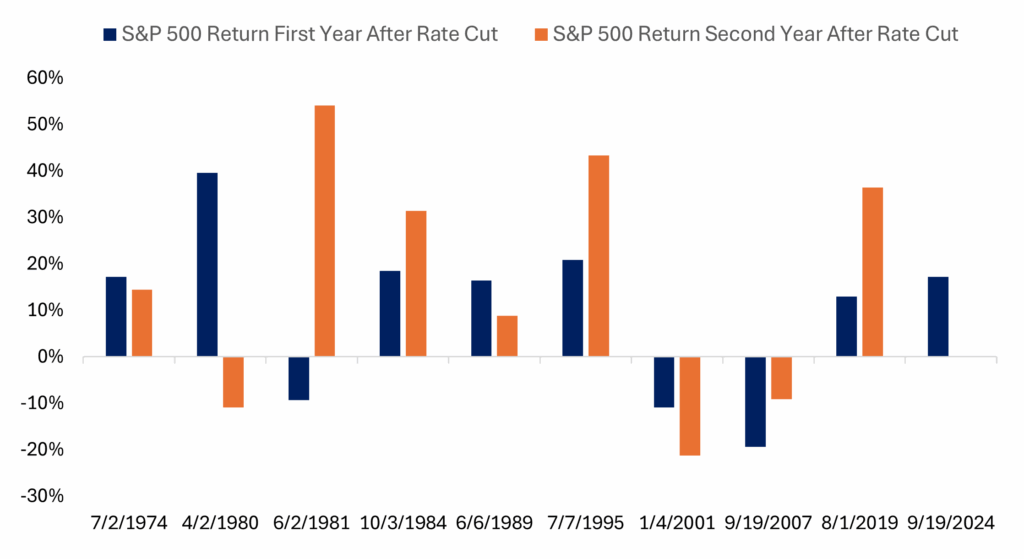

Here’s a chart from LPL Research that backs that up.

This shows us rate cutting cycles over the past 50 years. The blue line represents the return of the S&P 500 Index in the year following the first cut. The orange line represents the return in the second year after the first cut.

The average gain during year one was 9.6% and median gain was 16.4%. The Index is up about 17% this time around.

In year 2, the average gain was 16.4%, and the median gain was 14.4%. So, historically speaking, stocks may do very well in the next 12 months.

When Recessions Change the Story

But there are some negative returns in there. 3 times in the 10 rate cutting cycles measured, the index was down in year 2: 1981, 2002, and 2008. In all three of those, the economy entered a recession. So, whether or not stocks go up from here, greatly depends on whether we enter a recession or not. We won’t know that until it happens.

Economic Growth Outlook for 2026

LPL Research believes economic growth will continue in 2026, powered by stable interest rates, cooling inflation, fiscal stimulus, continued robust artificial intelligence investment, productivity gains, and more rate cuts.

Potential Market Headwinds

Of course, on balance, there are headwinds that could disrupt that course. LPL points out deficit spending may put pressure on long-term interest rates. A stalled job market may spark recession fears. And legal challenges to tariffs bring uncertainty.

The Investor Takeaway: Control What You Can Control

As always, it comes down to controlling what you can control. Never bet it all on a prediction of either direction of the stock market in the next 12 months. Stay diversified and stick to your plan for financial independence.

Securities are offered through LPL Financial, Member FINRA/SIPC. GenWealth Financial Advisors is an other business name of Independent Advisor Alliance, LLC. All investment advice is offered through Independent Advisor Alliance, LLC, a registered investment adviser. Independent Advisor Alliance, LLC is a separate entity from LPL Financial.