It’s never too early to start thinking about retirement. If you’re wondering how much savings you should have to prepare for retirement, let’s discuss some financial targets to aim for while preparing to support your lifestyle during your golden years.

Financial Milestones by Age

The current retirement age in the United States is 67. According to many experts, you should have 10 times your income saved if you want to retire before 70. This may seem like a lot, but this figure includes all your financial assets, such as:

- Your savings account

- Retirement accounts, like a 401(k) or Roth IRA

- Company matches

- Investments

- And other funds

While timing varies from person to person, here are some general age-related financial milestones that can help you get on the road to retirement.

How Much Should I Have Saved for Retirement by 30?

Your 20s and 30s are about financial independence — not just from parents but also from debt. While retirement may feel far away, it’s important to start thinking about your future. That means saving one times your income by the time you turn 30 so your nest egg has time to grow. So, if you make $40,000, your combined savings and assets should equal about $40,000.

Other financial milestones to focus on during your late 20s and early 30s include:

- Student loan repayment

- A good credit history in the low 700s or higher

- Three to six months of income set aside for emergencies

- Life insurance to protect loved ones if needed

- The beginnings of an estate plan

How Much Money Should I Have Saved by 40?

Your 40s and early 50s are your peak earning and wealth accumulation years. This period is also the height of your financial responsibilities, including kids, a mortgage, and college savings. If you have stayed on track for retirement, it’s recommended you have three times your income saved by age 40. That means if you make $60,000, you should have about $180,000 in savings.

Other financial milestones you could focus on achieving by 40 include:

- Established college savings for your children

- Diversification of your investment portfolio

- Increased job skills and knowledge to remain competitive in your chosen field

*There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. (26-LPL)

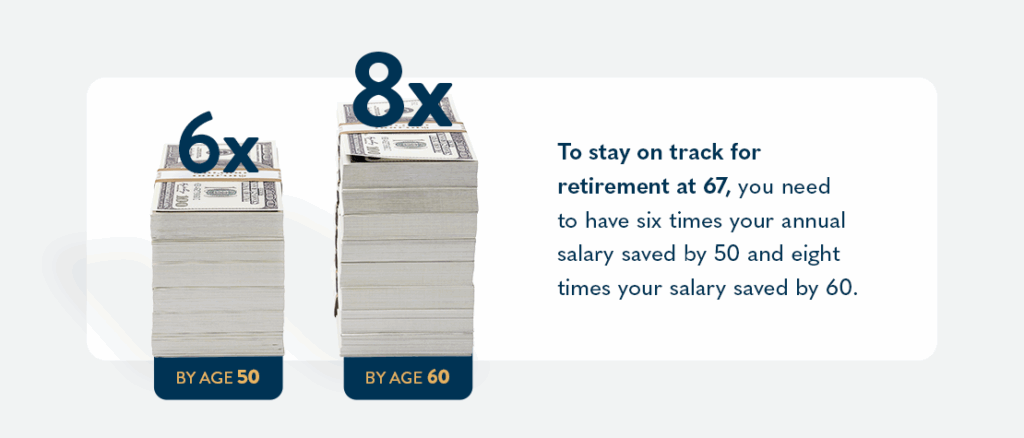

How Much Savings Should I Have by 50 and 60?

While most people in their 50s are still working hard in the job force, they begin seriously considering retirement as they enter their 60s. To stay on track for retirement at 67, you need to have six times your annual salary saved by 50 and eight times your salary saved by 60. That means the same salary of $60,000 annually equals $360,000 and $480,000 in savings, respectively.

Other financial milestones to strive for include:

- Paying off debts before retirement, including your mortgage, home equity loans, and credit cards

- Increasing your knowledge of Medicare, Social Security, and other retirement benefits

- Defining and pursuing personalized retirement goals

- Partnering with a financial advisor for professional retirement planning services

Plan for the Future With GenWealth Financial Advisors

Many of the milestones mentioned here are aspirational. So, if you feel behind, don’t worry. The team at GenWealth Financial Advisors can help you prepare for retirement. We tailor our retirement planning services to your unique financial situation, providing the strategies and tools you need to prepare for the next chapter and leave a legacy to your loved ones.

It’s never too late to start. We invite you to contact us and schedule a consultation to learn more.